The risk/reward ratio is used by traders and investors to manage their capital and risk of loss. If you don’t know what the risk:reward ratio is then here is bit of an explanation.

Forex Calculate Risk Reward Ratio Forex Ea List

Forex Calculate Risk Reward Ratio Forex Ea List

Risk reward ratio written by forex da posted on january 30, 2021 january 30, 2021 less than 0 min read results or failure from currency trading trading mainly depends on to income management.

Risk reward ratio forex. If you risk 10 pips on a trade and. Risk reward in forex is similar to any other investment when comes to money management, however, the difference lies in the trading strategy used in forex and other asset classes. As you know, the opening of just about every trade is involved with the danger of losing money.

The risk to reward ratio formula is quite straightforward. In this case, the ratio is 5:20. Consider placing a trade, and your stop loss is set at 5 pips, and your take profit is set at 20 pips.

Risk is the distance from the entry price to the stop loss price and reward is the distance from entry price to the target/ exit price level. In this model, you would wind up around breakeven as the misfortune per exchange approaches the benefit per exchange. Whatever the risk is (a.k.a.

The number we place in front of it is our multiple. Which is why it is so crucial to management the danger. If you risk 40 pips on a trade and you plan a profit target of 120 pips, then your effective risk to reward ratio for that trade would be 1:3.

Risk reward ratio tool is a professional algorithm, that calculates risk of every transaction before it is finalized. Golden line indicator v3 free download indicators best forex indicator 2021 free download indicators forex non repaint trend indicator indicators candlestick pattern indicator indicators quick links. In simple terms, the risk:reward ratio is a measure of how much you are risking in a trade for what amount of profit.

You are risking five pips for the chance to gain 20 pips. This article will take you on a journey into my mind and will hopefully prove to you that if you simply implement proper risk. The risk/reward ratio is therefore 150/50 = 3.

To calculate risk reward ratio in forex in the above example, it is the amount of risk divided by the reward. How to calculate risk to reward ratio. The larger the profit (target) against the loss (stop loss), the smaller the risk/reward ratio which means your risk is smaller than your reward.

How to calculate risk reward ratio for your trade The reward to risk ratio (rrr, or reward risk ratio) is maybe the most important metric in trading and a trader who understands the rrr can improve his chances of becoming profitable. There’s nothing that is extremely certain in the trading market and there are too many external factors which.

The main expertise lies in forex (currency) trading. For example, in the event that we take 100 exchanges, all having a risk reward ratio of 1, with a triumphant pace of half, there will be 50 victors and 50 failures. Risk reward ratio indicator analyses the risk thoroughly, before position is opened.

The stop loss), don’t ever settle for a lower reward; What is the recommended risk/reward ratio in forex trading? The ratio helps assess the expected return and risk of a given trade.

Risk reward is a simple concept, but how you deploy and use it in your trading can be as advanced as you like. At its most basic, risk reward is the formula for how much reward you stand to make for the amount you are risking. Your capital or investment is the ‘risk,’ and your target profit is the ‘reward.’ here’s an example:

One of the biggest foundations of forex trading success is the knowing what the risk:reward ratio is and applying in live forex trading. Read on to find out how i use a favorable risk to reward ratio in the forex market to stack the odds in my favor. Trade with risk reward ratio 1:2.

Risk reward ratio indicator is compatible with metatrader 4 and metatrader 5 platforms. First off, the “r” stands for risk. What is risk to reward ratio and how to calculate it in forex trading.

Rolf and moritz share their trading strategies across all timeframes. Therefore, it is much easier to make investment decisions. =divide your net profit (the reward)/the price of your maximum risk =120/40 =3.

The risk/reward ratio is used by many forex traders to assess the expected return and the risk of a trade. Let’s say you are a scalper and you only wish to risk 3 pips. So what exactly is a risk/reward ratio and how does it apply to forex trading?

First, a risk/reward ratio refers to the amount of profit we expect to gain on a position, relative to what we are. For example, if your stop loss is 20 pips in a trade and your target is 100 pips, your risk/reward ratio will be 1:5. Anything beyond 1:1.5 is not a high reward ratio, but a.

Using a 3:1 reward to risk ratio, this means you need to get 9 pips.

Complete RiskReward Ratio Guide For Forex Traders

Complete RiskReward Ratio Guide For Forex Traders

InvestSoft Forex EA Forex Indicators Forex Tools

InvestSoft Forex EA Forex Indicators Forex Tools

Risk Reward Ratio Indicator MT4/MT5 Forex Factory

10 Forex Trading Rules Of Technical Trading That We Should

Forex Risk Reward 1 1 Ovp Forex System

Forex Risk Reward 1 1 Ovp Forex System

How To Use The Risk/Reward Ratio In Forex Trading? AndyW

How To Use The Risk/Reward Ratio In Forex Trading? AndyW

Basic Money Management StrategiesRewardtoRisk Ratio In

Basic Money Management StrategiesRewardtoRisk Ratio In

Why a 11 Risk Reward Ratio is best for forex trading

Why a 11 Risk Reward Ratio is best for forex trading

Forex Risk And Reward Ratio Easy Forex Trading Method

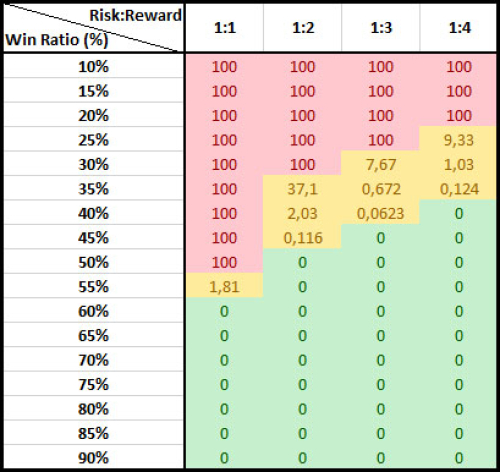

How to use risk reward ratio and winrate to trade better

How to use risk reward ratio and winrate to trade better

How To Get A Lot Size Calculator Indicator In MT4 Only

How To Get A Lot Size Calculator Indicator In MT4 Only

In Practical Risk Management, you must set orders and risk

In Practical Risk Management, you must set orders and risk

Money Management the Secret to Steady Profitability

Money Management the Secret to Steady Profitability

Money Management in Forex More Than Just Trading

Money Management in Forex More Than Just Trading

The Right Risk to Reward Ratio Forex Day Trading MT4

The Right Risk to Reward Ratio Forex Day Trading MT4

No comments:

Post a Comment