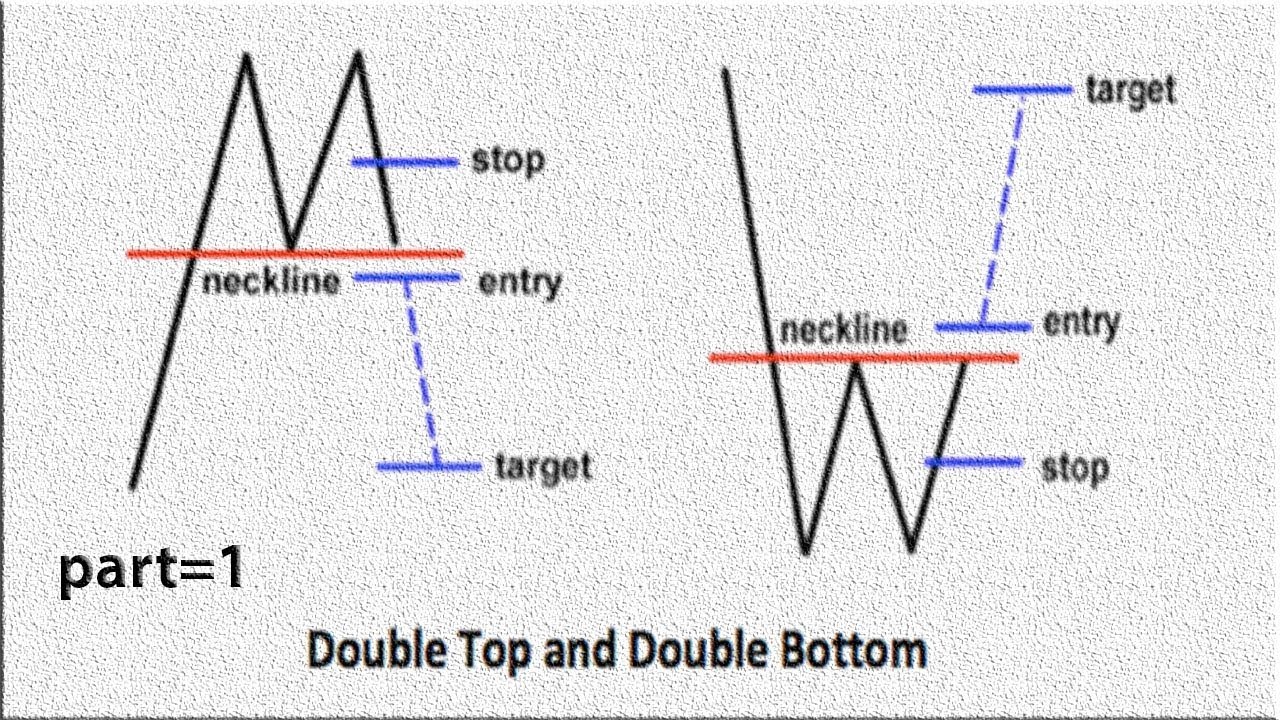

When a double top or double bottom chart pattern appears, a trend reversal has begun. Place an sl behind the high and calculate the tp based on the height of the pattern.

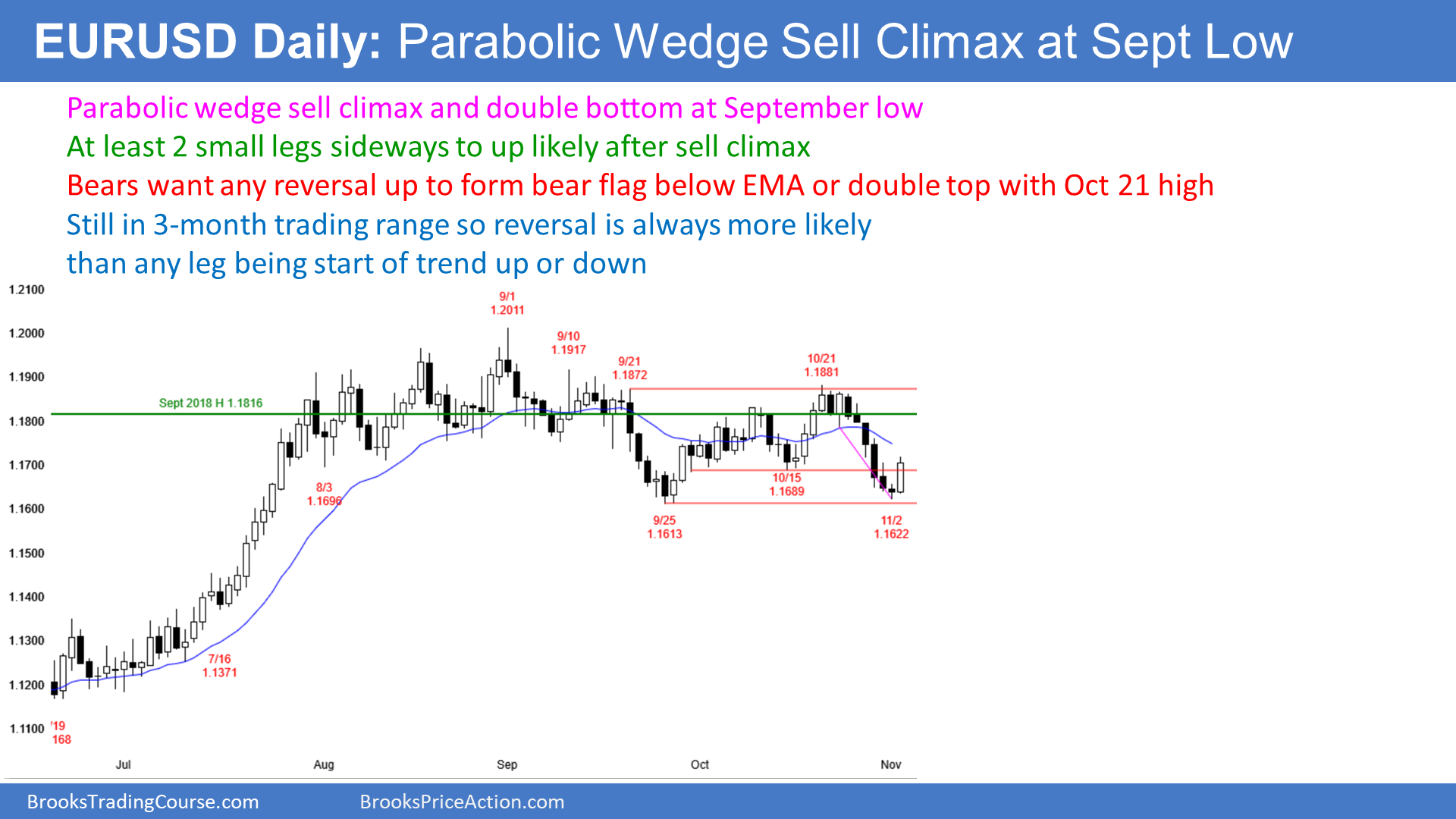

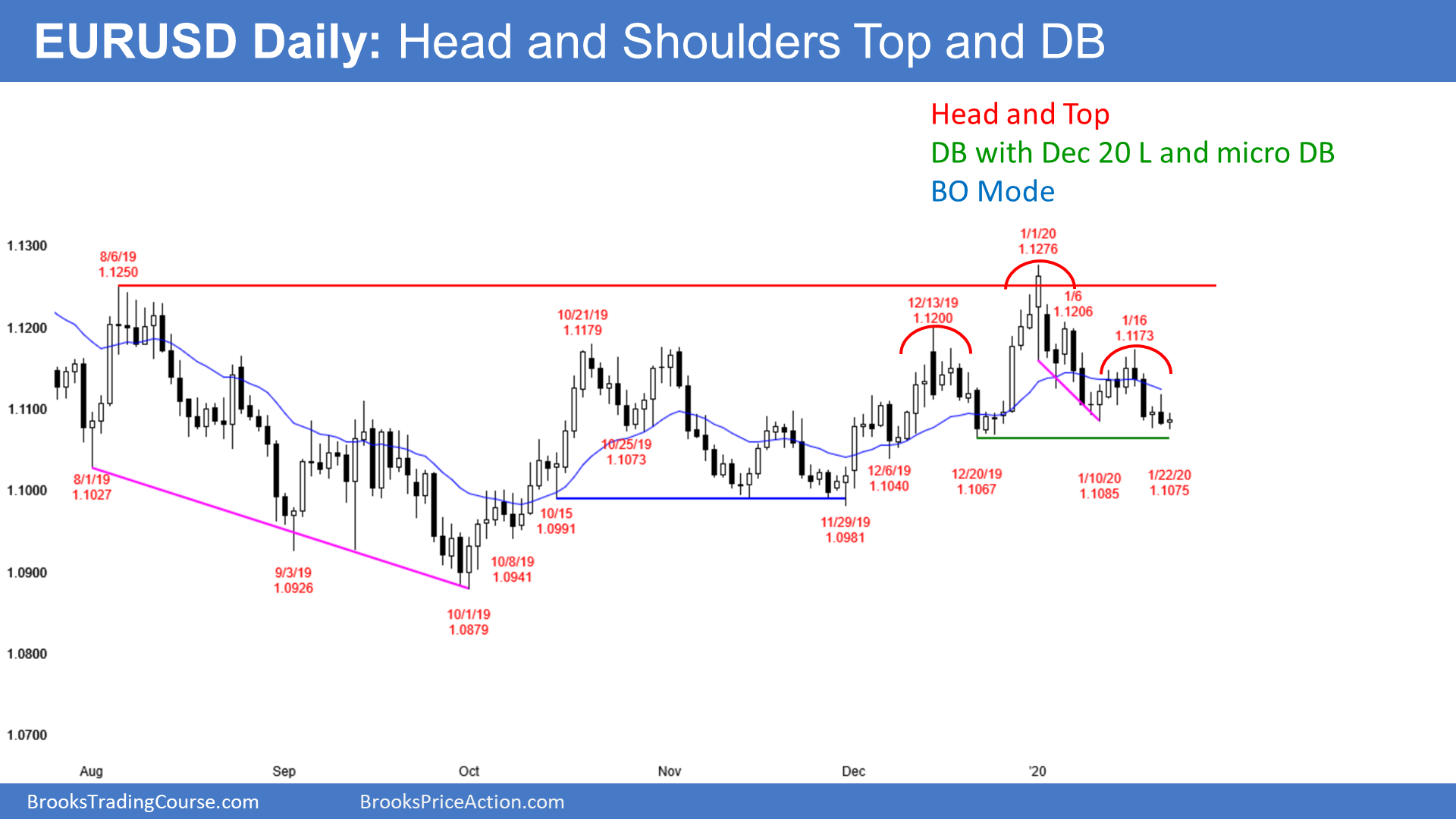

Emini parabolic wedge sell climax and double bottom with

Emini parabolic wedge sell climax and double bottom with

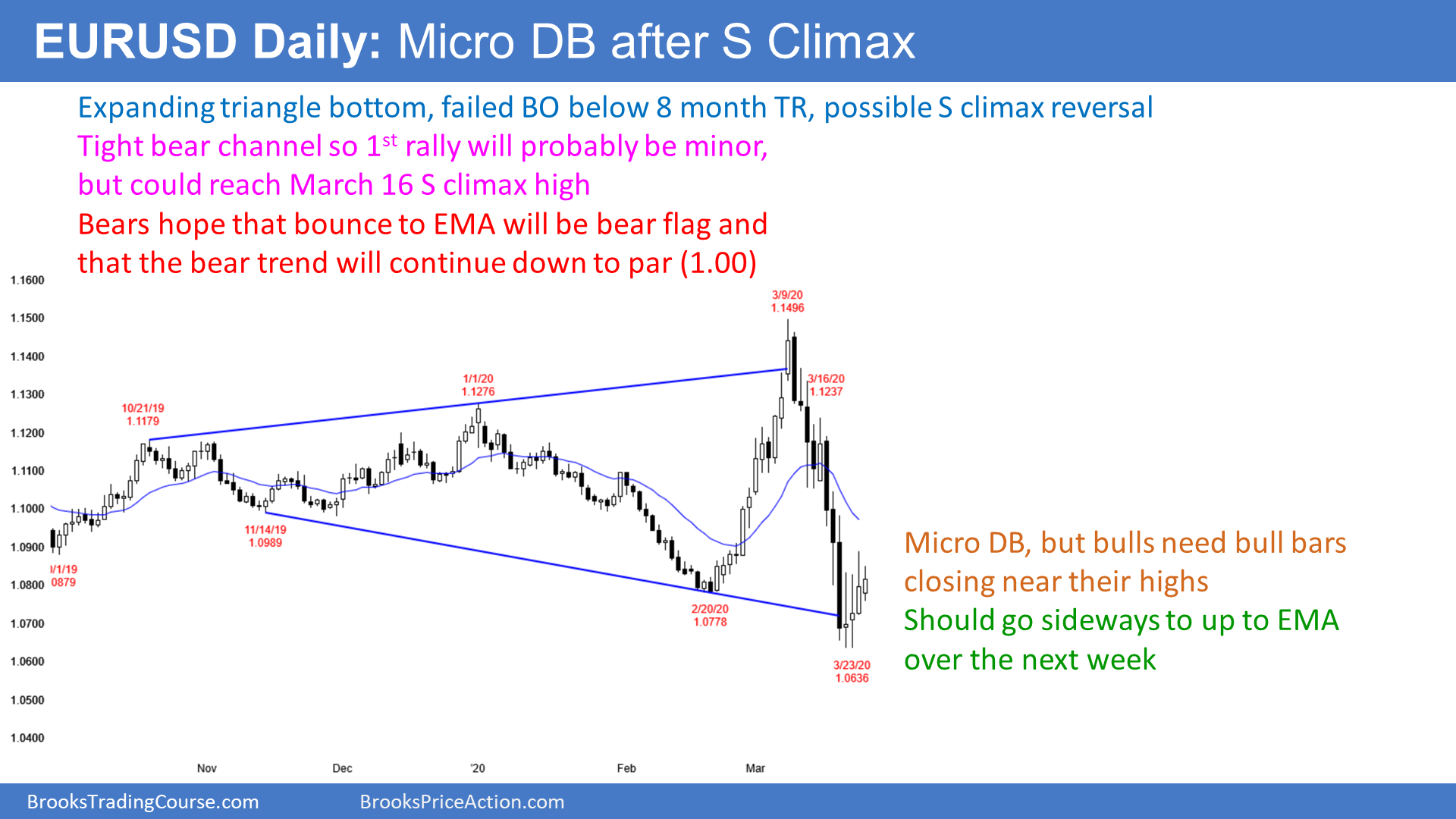

The double bottom forms after an extended move down and can be used to find buying opportunities on the way up.

Double bottom forex. As long as the double bottom forms at the bottom of a downtrend, open buying trades. The fast rejection shows the strong momentum of the move. This means the double bottom is showing a possible signal.

In the above picture, prices were in a downtrend until the price reached a low at point a and bounced back to c. None required the double bottom chart pattern is considered as a bullish reversal chart pattern. This is like a double top reversed.

The conventional wisdom says that once the pattern is broken, the trader should get out. Pada pembahasan kali ini kami akan mencoba untuk menjelaskan kepada anda istilah dasar di dalam forex ini yaitu double top dan double bottom. A good double top/bottom should take out a recent top/bottom followed by a fast rejection.

A double bottom chart pattern is made up of two bottoms or lows. A large trend reversal may be in the works. Simak penjelasannya di bawah ini.

A double bottom pattern is quite similar to a double top, only that it usually forms during downtrends and signals an upcoming uptrend. The algorithm is as follows: You can trade this chart pattern strategy on any time frame.

A double bottom may be in play but is not confirmed until price action breaks above 1.342 resistance. Most traders are inclined to place a stop right at the bottom of a double bottom or top of the double top. As the name implies, the double bottom pattern consists of two bottoms that form at a key support level.

That is a double bottom with a lower low, but the stochastic indicator is showing a higher low. The “tops” are peaks which are formed when the price hits a certain level that can’t be. The preference is for a rebound higher towards 1.365.

The double bottom marks a downtrend in the process of becoming an uptrend. Price then retraces to the neckline and then falls back to the down side. The first bottom forms immediately after a strong downtrend trend.

Let’s start by looking at the typical characteristics of a double bottom, a double bottom majorly consists of 4 major parts. Trade top and bottom pattern forex strategy it is a strategy that seeks the tops and bottoms with an mt4 indicator that performs this function, then, when a top or bottom is presented, it enters the position if it is confirmed by trend indicators, so it is not immediately entered as in a normal strategy price action but seeks confirmation. Traders also observe the volume after the establishment of the double bottom.

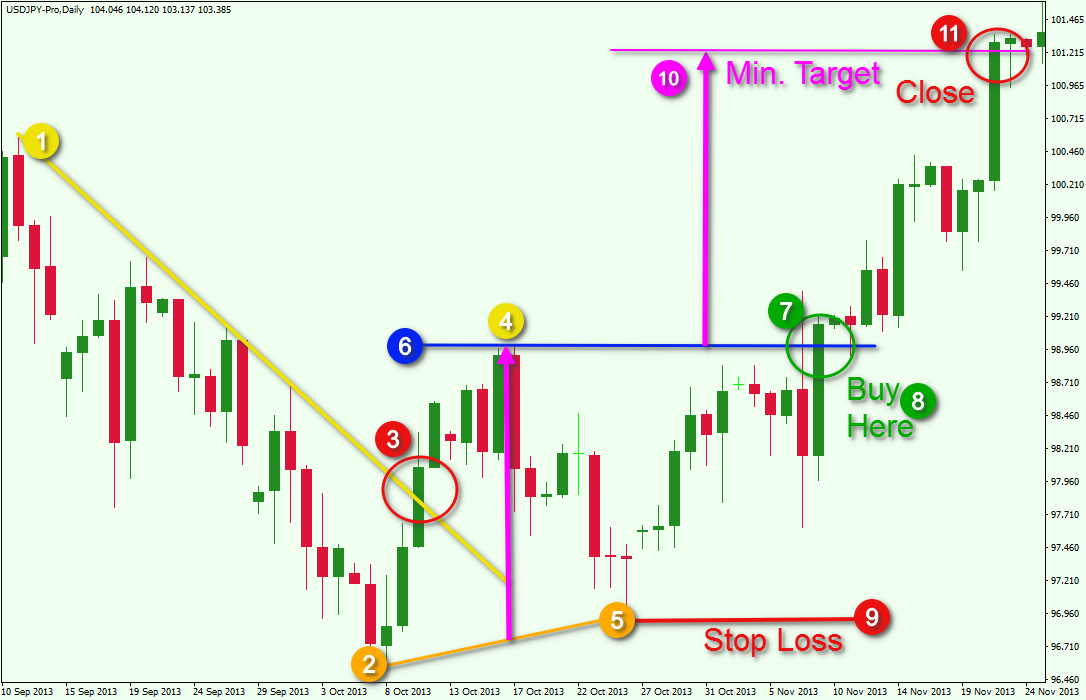

When it comes to trading the double bottom in the forex market, there are 3 ways to trade it. So if you had missed the entry on the first double bottom (with the lower low), you would have another chance to enter on the second double bottom (with the higher low). It is a bullish reversal pattern.

“double top” is a bearish pattern, and “double bottom” is a bullish pattern, but other than that, the methods of trading these patterns are mirror of each other. The charts below show how this pattern is utilized in both markets. The double bottom looks like the letter w.

The strong momentum is a sign that the smart money has most probably finished its accumulation phase and starts its profit release phase (the big move). The double bottom pattern is one of my favorite technical patterns to spot a potential reversal in the forex market. The double bottom is frequently used in the forex and equity markets as buy/bullish signals.

This is how technical analysts trade the double bottom and is the most standard way of trading it. How to trade forex double bottom pattern. Nzd/usd do uble bottom chart pattern.

A double bottom pattern in forex comprises of two bottoms below a resistance level(the neckline) giving it a shape of a w. The double bottom forex reversal, as the name suggests, is a trend reversal pattern. Pertama ada pola double top yang akan dengan mudah ditemukan pada area tertinggi di sebuah tren yang naik.

The double bottom pattern forms when the bottoms and a neckline is formed. The double bottom pattern is a reversal pattern similar to the double top pattern. At point c prices then stalled and went again lower to reach point b.

In a double top pattern, the price fails to form a fresh lower low and faces support at the previous swing low, which now acts as a horizontal support level for the price. Let me show you all the above in an illustration. After the price reaches the resistance level for the second time (ideally, the candlestick closes above it), open a buying trade.

A double bottom pattern can be traded by opening a buy (long) order when the second bottoms occur. A double top is a reversal pattern that is formed after there is an extended move up. It is basically going to turn a downtrend into an uptrend.

A double bottom is only complete, however, when prices rise above the high end of the point that formed the second low. Forex.com is a registered fcm and rfed with the cftc and member of the national futures association (nfa # 0339826). The advance of the first bottom should be a drop of 10% to 20%, then the second bottom should form.

All of them work well, so it comes down to which one you feel the most comfortable trading. The double bottom is a reversal pattern of a downward trend in a stock's price. Double bottom occurs when prices form two distinct lows on a chart.

The chart above describes that right after the development of the double bottom, the stochastic identifies an overbought condition. In other words, if on the one hand we increase. Double bottom pattern forex trading picture d:

The double bottom chart pattern forex trading strategy is the opposite of the double top chart patten forex strategy and it is also a price action trading strategy. Hence there is a regular divergence there. The bottoms are known as support zones that are very important zones that can influence the price in the forex market.

However, the bigger the time frame the bigger the potential profit. Examples of trading “double top/bottom” patterns in forex navigation: Double bottom candlestick pattern with stochastic oscillator.

Let’s learn how to identify these chart patterns and trade them.

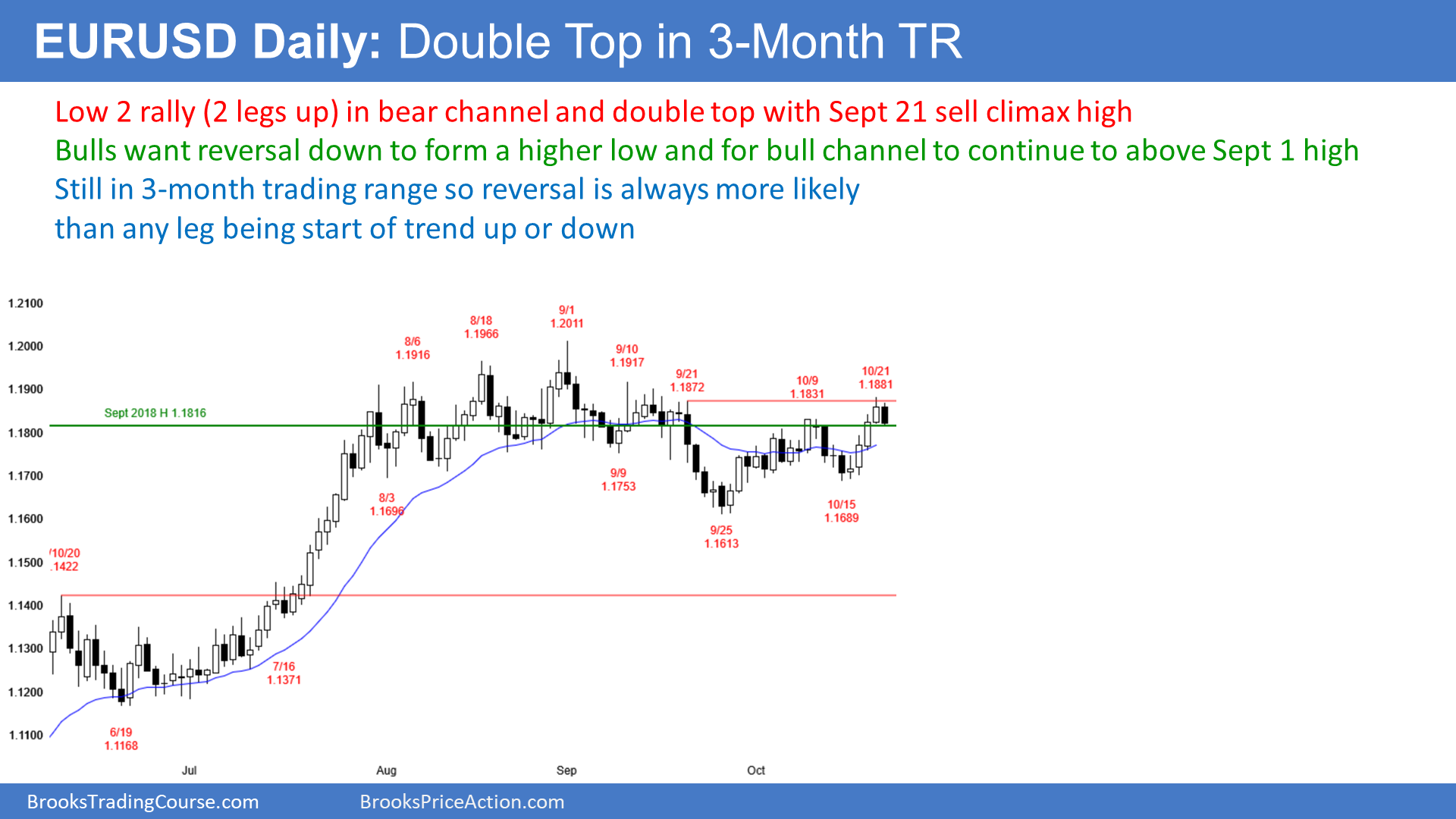

Emini buy climax and maybe late November profit taking

Emini buy climax and maybe late November profit taking

Forex Chart Patterns Forexearlywarning

Teknik Double Top Forex Forex Ea Hft

Teknik Double Top Forex Forex Ea Hft

Emini new all time high found sellers

Emini new all time high found sellers

forexchartpatterntradingondoubletop LearnForex

forexchartpatterntradingondoubletop LearnForex

Emini micro double bottom at September 16 high

Emini micro double bottom at September 16 high

An Entry Derived from a Double Bottom Forex Academy

An Entry Derived from a Double Bottom Forex Academy

Double Bottom Forex Strategy Explained Part 2 Beginner

Double Bottom Forex Strategy Explained Part 2 Beginner

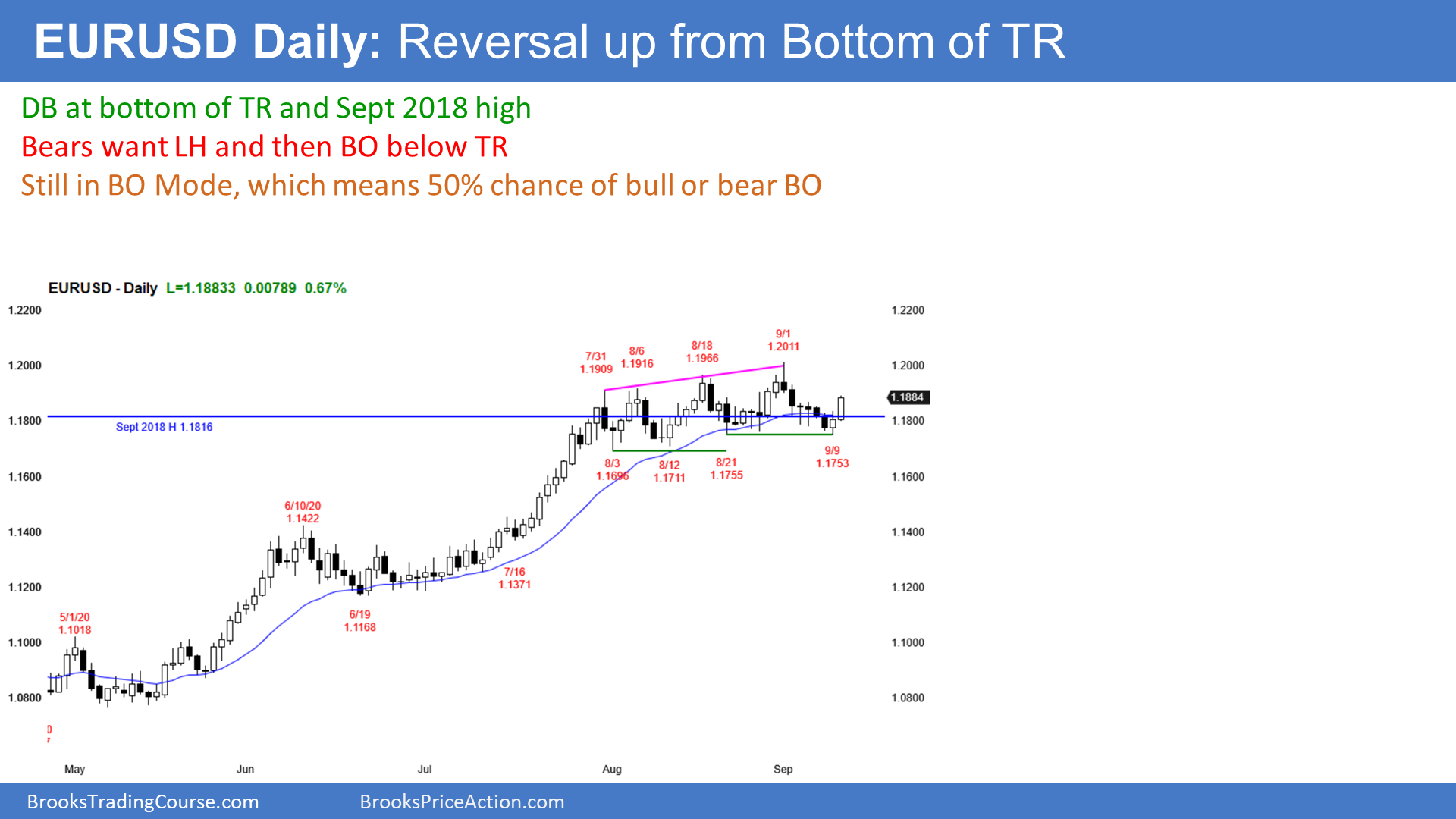

Double bottom in D1, top level of trend line broken in EUR

Double bottom in D1, top level of trend line broken in EUR

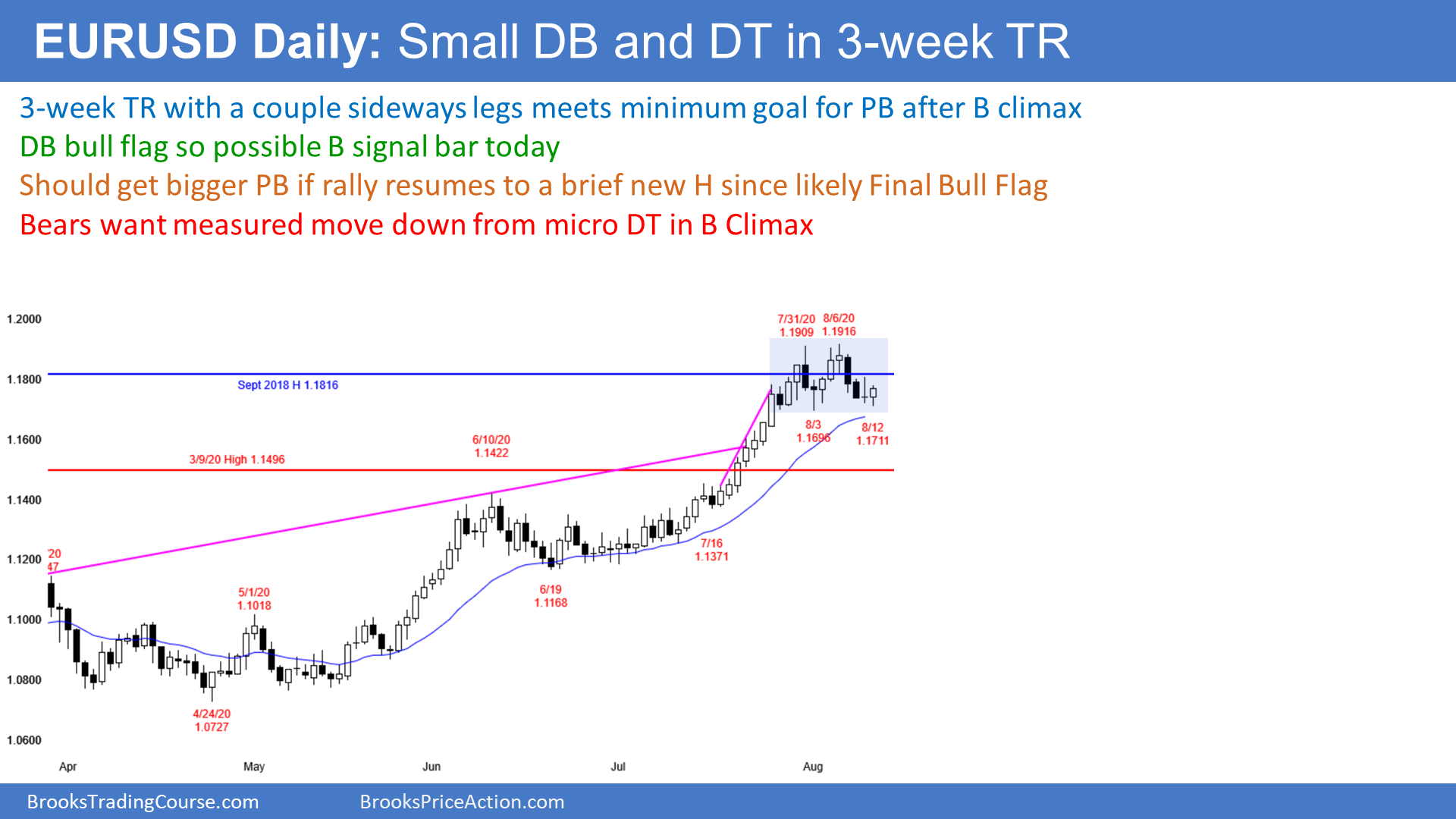

Emini late August buy climax should pause today

Emini late August buy climax should pause today

best price actionHow to Trade idea double bottom chart

best price actionHow to Trade idea double bottom chart

Forex KRIX.HU ONLINE MEDIA PRODUCTIONS

Forex KRIX.HU ONLINE MEDIA PRODUCTIONS

The Double Bottom and the Flipped Level of Support Forex

The Double Bottom and the Flipped Level of Support Forex

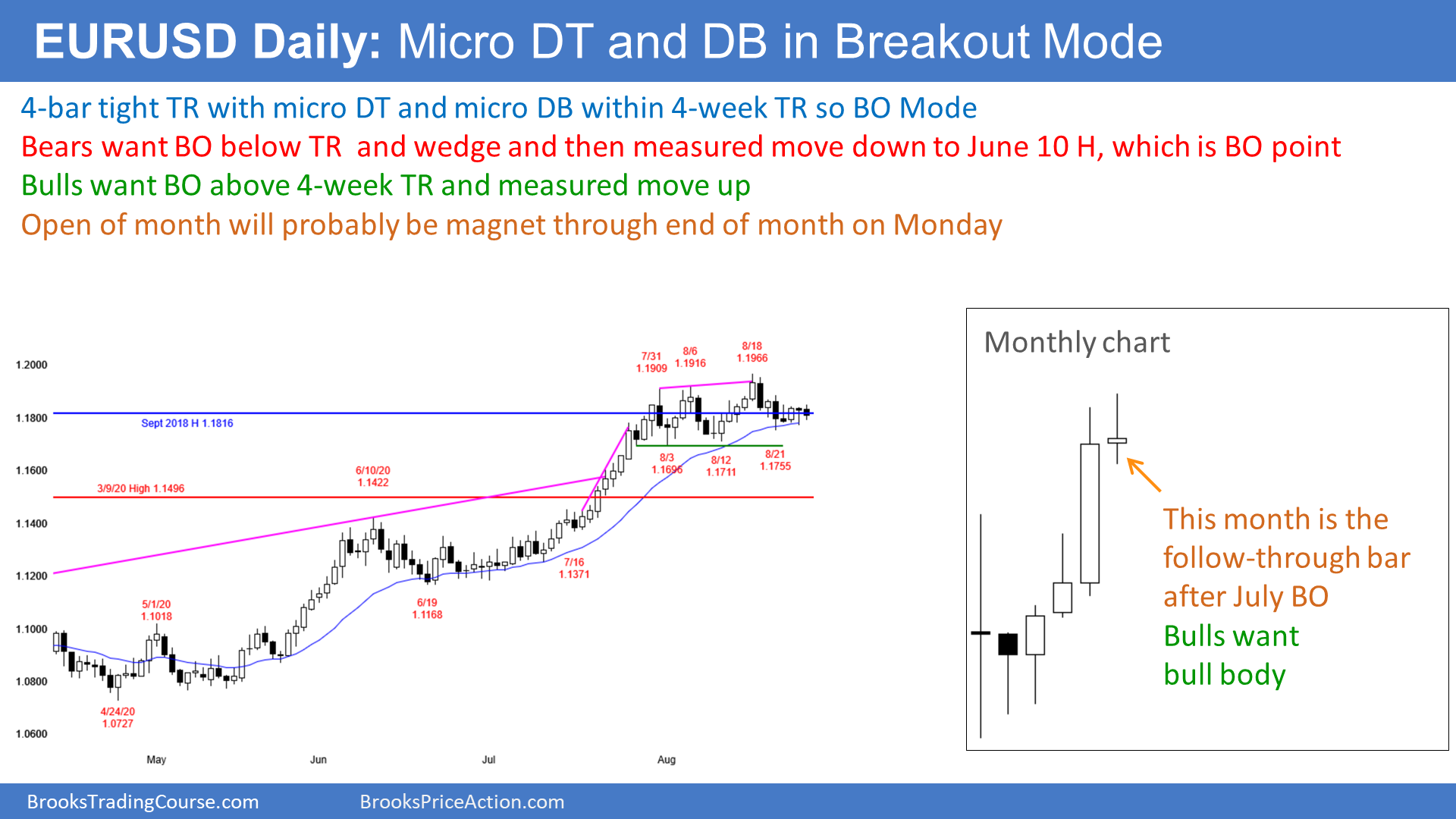

Emini micro double top in January buy climax Brooks

Emini micro double top in January buy climax Brooks

Emini short covering rally will lead to April trading

Emini short covering rally will lead to April trading

How To Trade Double Top and Double Bottom Patterns

How To Trade Double Top and Double Bottom Patterns

Emini strong minor bounce from September sell climax

Emini strong minor bounce from September sell climax

No comments:

Post a Comment