Being bearish is the exact opposite of being bullish—it's the belief that the price of an asset will fall. A trade may be bearish about a particular category of assets or a specific company, currency.

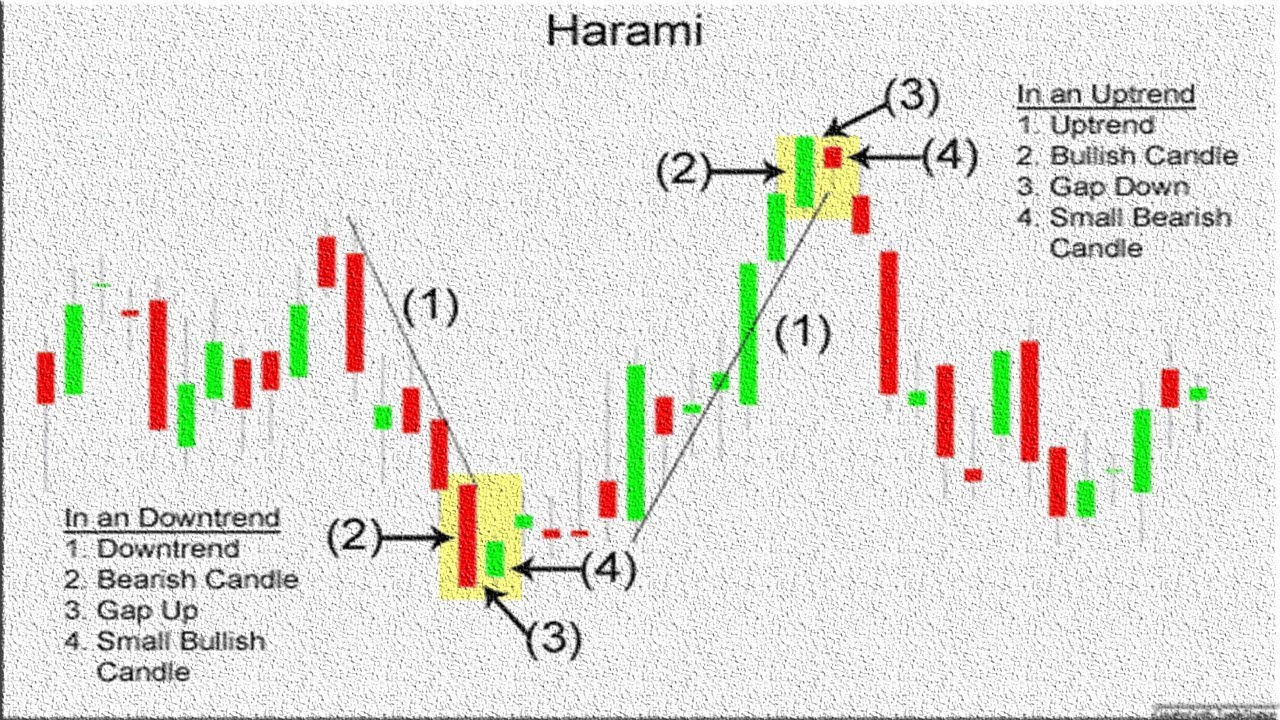

How to use Bullish HaramiBearish Harami Candlestick

How to use Bullish HaramiBearish Harami Candlestick

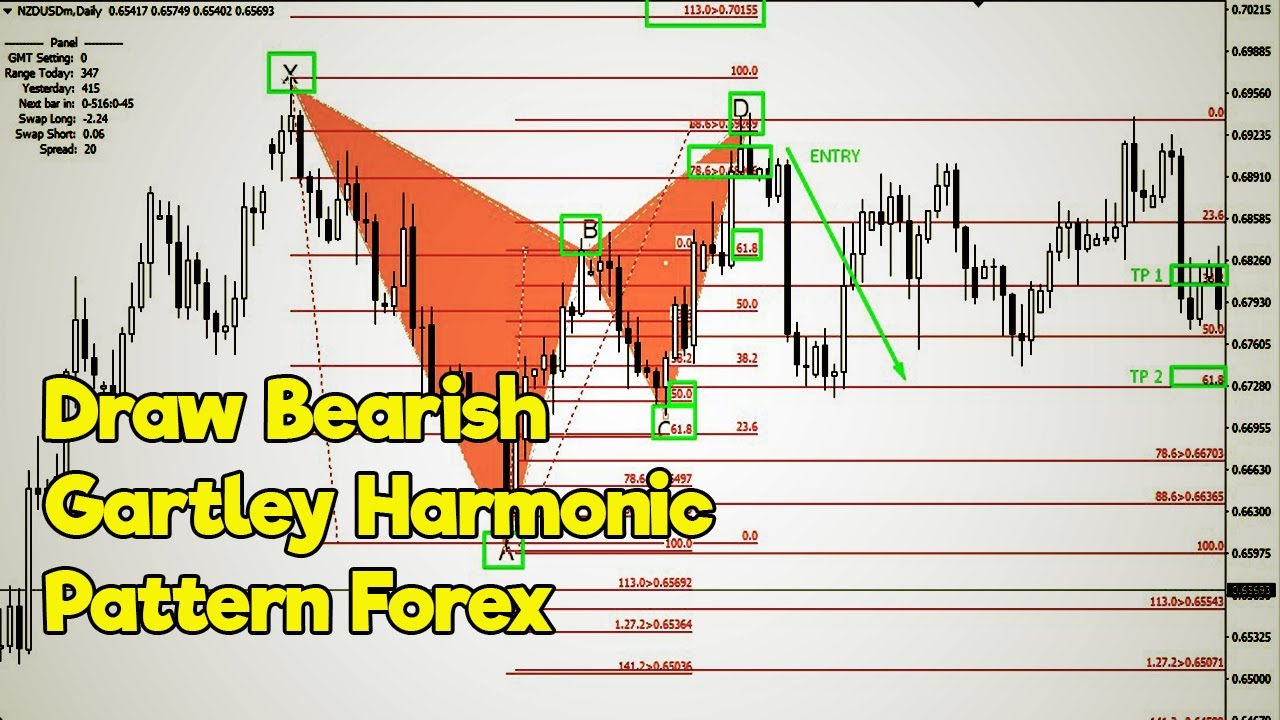

Identify opportunities in the forex markets using the bearish gartley pattern.

Bearish forex. Nevertheless, the price remains below the 100 hour moving average (currently at 0.87649) and. The bigger the difference in the size of the two candlesticks, the stronger the sell signal. Sementara itu, three inside down adalah:

These are the most common types of bearish candlestick patterns in forex: *ospreyfx would like to state that traders should research extensively before following any information given hereby. Feb 19 21, 10:01 gmt.

For traders, being bearish believes that the asset value will decrease and is the opposite of bullish. Octa markets incorporated is a forex broker recognized worldwide. The small red candle opens close to, or at the level that the prior bullish candle closed at.

Any assumptions made in this article are provided solely for entertainment purposes and not for traders to guide or alter their positions. The pattern can be bearish. In forex, bullish traders expect a rise in the exchange rate, whereas bearish traders are expecting a fall in the exchange rate.

This is typically observed in. The second candlestick is bearish and should open above the first candlestick’s high and close below its low. A bearish harami cross is a large up candle followed by a doji.

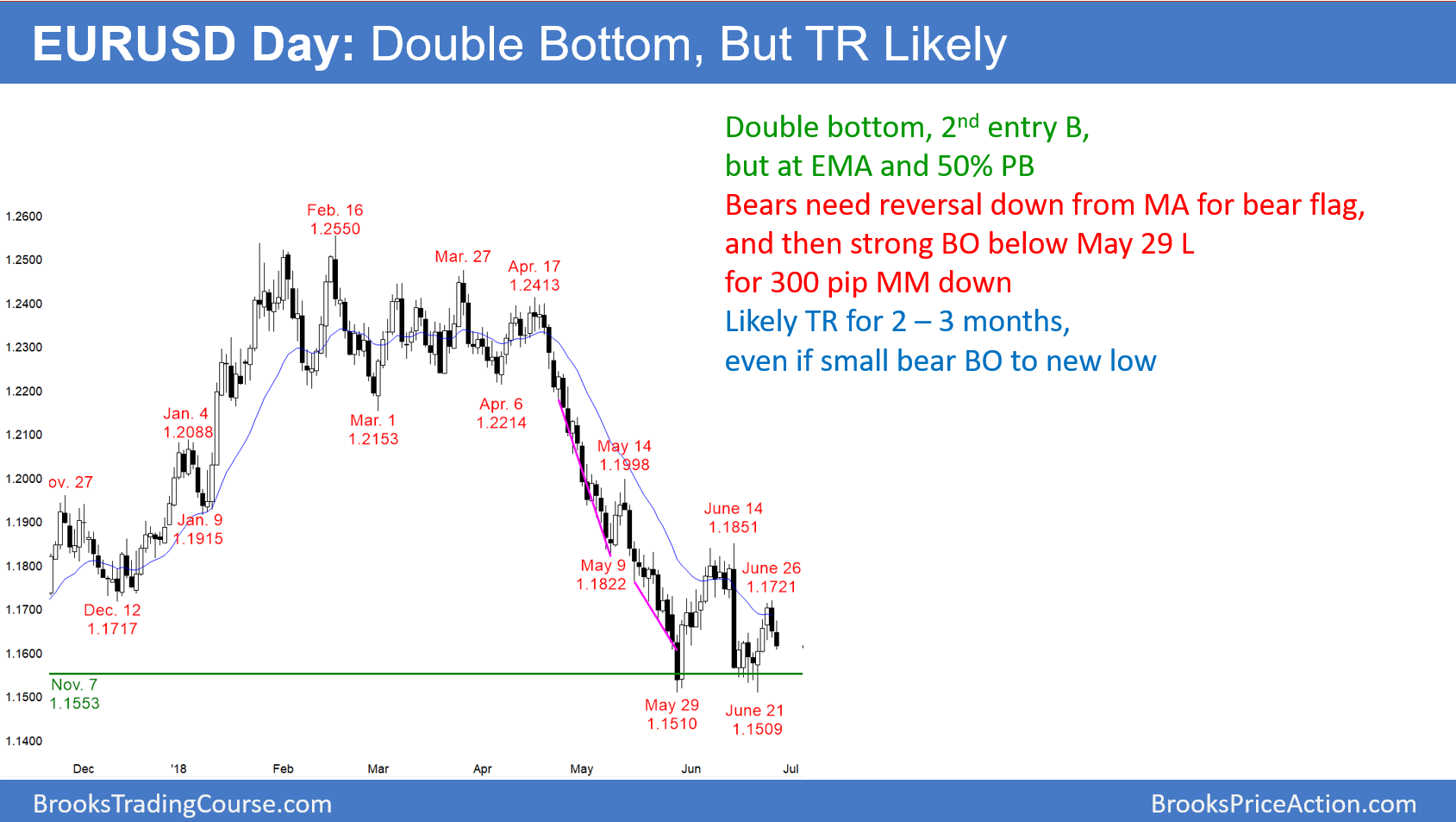

In this example, price broke the bottom of the rectangle chart pattern and continued to shoot down. What are bullish and bearish trends? The bearish market is opposite to bullish:

We introduce people to the world of currency trading, and provide educational content to help them learn how to become profitable traders. This happens because sellers probably need to pause and catch their breath before taking the pair any lower. A bearish engulfing pattern indicates lower prices to come and is composed of an up candle followed by an even larger down candle.

The bearish harami cross pattern suggests that the previous trend may be about to reverse. A bearish pennant is formed during a steep, almost vertical, downtrend. The pair will likely continue rising as bulls target the next resistance at 1.2156.

The eurgbp is quietly keeping a bearish bias, but admittedly is not going very far in either direction. This pattern produces a strong reversal signal as the bearish price action completely engulfs the bullish one. It occurs during an uptrend.

The bearish pattern signals a possible price reversal to the downside. Bearish candlestick patterns in forex are the direct opposites of their bullish counterparts. A bearish trend market or bear market is the condition of a financial market in which prices are falling or are expected to fall.

The term ‘bearish’ is applicable to all the financial markets, among others, the forex market, stock markets, commodities markets, and options markets. Forex crunch is a site all about the foreign exchange market, which consists of news, opinions, daily and weekly forex analysis, technical analysis, tutorials, basics of the forex market, forex software posts, insights about the forex industry and whatever is related to forex. A bearish rectangle is formed when the price consolidates for a while during a downtrend.

The bearish harami pattern in forex will often look something like this: On forex, both categories of traders expect a rise or fall in the exchange rate, buying or selling the base currency against the quoted one. They suggest a continuation of a major downtrend or the beginning of a new downtrend.

Forex.com is a trading name of gain global markets inc. In a bear market, traders are looking to enter the market when prices are falling so that they can buy once they believe that market has reached its peak. Babypips.com helps individual traders learn how to trade the forex market.

The dynamics of bearish markets. Just like with bullish opinions, a person may hold bearish beliefs about a specific company or about a broad range of assets. If this pattern continues, a break below the 8,000 mark is probably a good sign that further bearish pressure may arise, heading below the previous support towards the 38.2% fibonacci at 7,443.

Which is authorized and regulated by the cayman islands monetary authority under the securities investment business law of the cayman islands (as revised) with license number 25033. The term ‘bearish’ or ‘bear’ is based on the metaphor of a bear, swiping downwards with its paws, thus pushing prices down. We're also a community of traders that support each.

The strong selling shows the momentum has shifted to the downside. to say he's bearish on stocks means he believes the price of stocks will decline in value. Namun sebelum membahas lebih jauh tentang candlestick, ada baiknya anda mengetahui sedikit sejarah dari chart populer ini!

Either way, traders do so to be able to either buy or sell the currency pair for profit.

Options trading bearish screening stocks for day trading

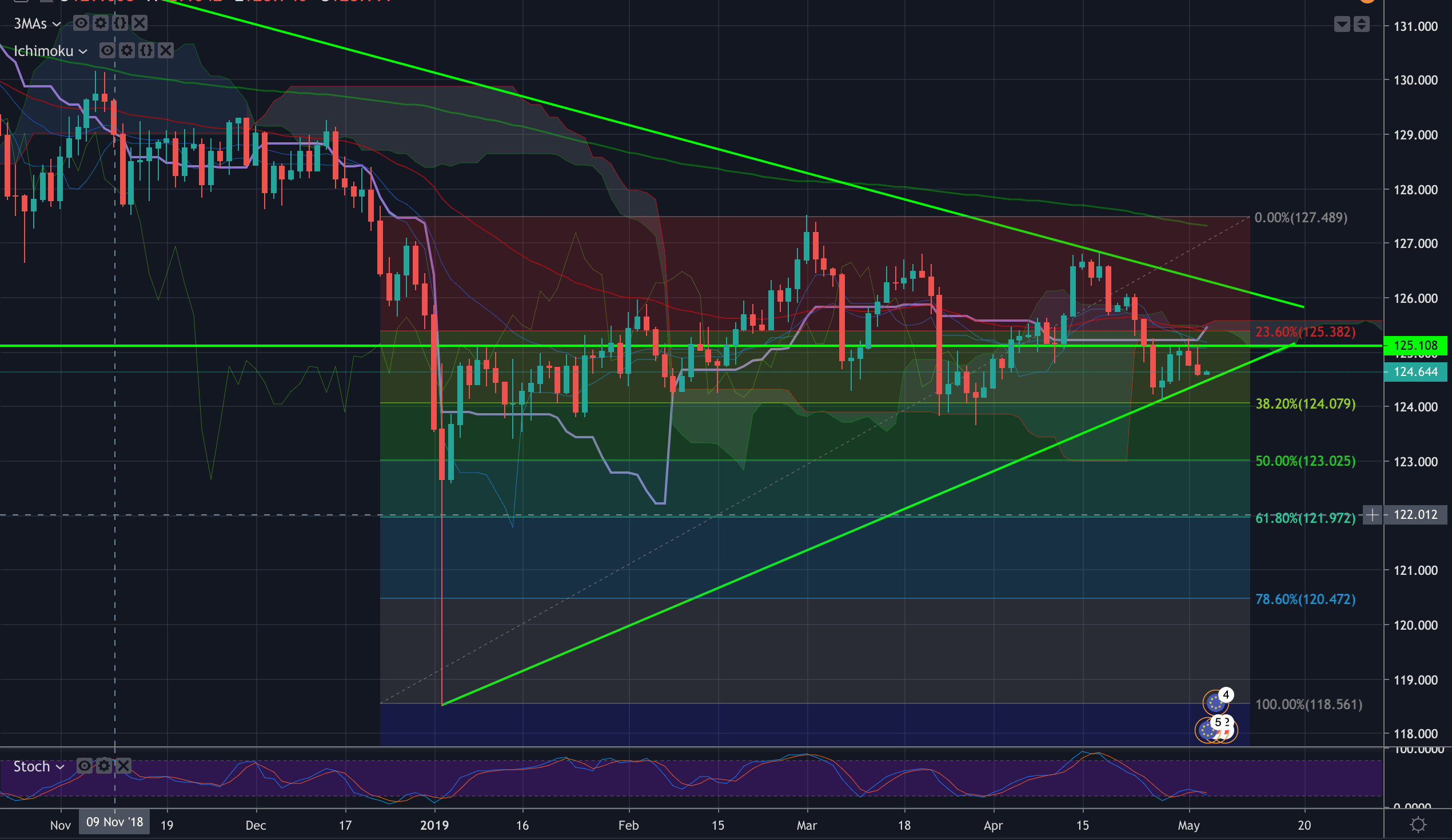

EUR/JPY Trapped below cloud and bearish MAs but 38.2

EUR/JPY Trapped below cloud and bearish MAs but 38.2

How To Draw Best Bearish Gartley Harmonic Pattern Forex

How To Draw Best Bearish Gartley Harmonic Pattern Forex

Profit forex mudah dengan bearish engulfing YouTube

Profit forex mudah dengan bearish engulfing YouTube

GBPCHF Daily Bearish & Bullish EWs 13 Nov 2018 www

GBPCHF Daily Bearish & Bullish EWs 13 Nov 2018 www

Pure Price Action Presentation 8 Bullish & Bearish

Pure Price Action Presentation 8 Bullish & Bearish

Emini doji inside day buy signal bar and seasonally

Emini doji inside day buy signal bar and seasonally

Bearish Forex Patterns Ea Forex Killer

Bearish Forex Patterns Ea Forex Killer

GBPUSD Bearish analysis, thoughts? Forex

GBPUSD Bearish analysis, thoughts? Forex

PENGENALAN FOREX DARIPADA IB HOTFOREX Teknik Bearish

PENGENALAN FOREX DARIPADA IB HOTFOREX Teknik Bearish

EURGBP Bearish Technical Outlook LEFTURN Inc.

EURGBP Bearish Technical Outlook LEFTURN Inc.

Echtzeit Forex Trading Signal Bearish Bat Pattern AUDUSD

Echtzeit Forex Trading Signal Bearish Bat Pattern AUDUSD

Forex Bearish Engulfing Bar Candlestick Forex Forex

Forex Bearish Engulfing Bar Candlestick Forex Forex

Forex Trading Signal Bearish Cypher Pattern EURAUD

Forex Trading Signal Bearish Cypher Pattern EURAUD

Bullish Trend and Bearish Trend What should Trader do

Bullish Trend and Bearish Trend What should Trader do

Trading Forex With Reversal Candlestick Patterns Forex

Trading Forex With Reversal Candlestick Patterns Forex

How to identify bearish and bullish candlestick pattern in

How to identify bearish and bullish candlestick pattern in

AUDUSD H4 BEARISH TP 0.674 250+ Pips Forex

AUDUSD H4 BEARISH TP 0.674 250+ Pips Forex

Emini Low 1 bear flag sell signal triggered on

Emini Low 1 bear flag sell signal triggered on

No comments:

Post a Comment