Money management is a critical point that shows difference between winners and losers. Even the best trades and the most profitable trading strategies won’t do much if you don’t have strict money management rules in place to protect your winning trades, cut your losses, and grow your trading account.

Forex Money Management Strategy Pdf Forex Ea Crack

Forex Money Management Strategy Pdf Forex Ea Crack

We believe it is time to open a new topic dedicated to money management.

Forex money management strategies. Use a take profit to secure your profits; Entering in most suitable trades with required amount of investment along with a handsome amount of capital will. When trading forex, getting the direction of the trade right is only one side of the coin.

Any forex money management strategy article or website talking about trading without mentioning the above, is giving you totally incomplete information about money management which could kill your account. Money management is perhaps the most important technique traders need to understand when trading the forex market. A complete guide to forex money management strategies.

Loss orders is an important component of forex money management that can save the trader a considerable amount of money in the event of an extreme adverse move in an exchange rate. I have studied money management strategies extensively. Money management that actually works in forex!

We have collected the list of 10 most efficient money management strategies that can help you become a successful forex trader. Follow these 5 tips for effective money management in the forex market. Try comparing two beginner traders with professionals, when tested using the same amount of money, the same strategy, but the end result will be different.

Here we'll be posting trading systems and methods that help to control losses, evaluate and limit risks, improve win : Always use stop losses 3. Everybody knows how vital it is to implement risk management strategies when day trading.

Money management strategies for serious traders presented by david c. If you liked this forex money management strategy article, make sure to comment below and click on the ‘like’ and ‘tweet’ buttons. With forex trading the best results i've found indicated that being able to initiate position sizes in 1000.00 increments was best.

The thinking goes that if they can just find the latest and greatest system all their dreams will come true and the millions will come rolling in. The best forex signals provider always gives you proper guidance for money management strategy forex and risk management depend on your position size and account size. Forex money management & exit strategies.

If you have a forex trading strategy below 70% win rate you should risk 5% of your capital on a trade.to me risking 1%is a waste time. Learn to use my price action strategies with the power of risk to reward ratios and. While money management for traders is a broad topic, the blog post will give you an idea of the rudiments of managing money.

Theforexsecret.com 1 content at a glance introduction money management strategies. For another great article on money management trading strategies, make sure to check out your equity threshold and the psychology of money Some traders will also use a trailing stop loss as the initial position becomes profitable.

Every forex traders should follow the forex money management strategies to determine their risk per trade and reward of winning trade. Money management is a critical point that shows difference between winners and losers. Do not risk more than you can afford to lose;

Don’t trade based on emotions 6. Stendahl the importance of money management traders can typically describe the methods they use to initiate and liquidate trades. I have concluded their most effective use comes from a consistent strategy yielding a high win/loss ratio that has a predictable string of wins and losses.

Forex trading money management strategies, although sometimes this is quite confusing and boring, this is a very important lesson in trading on the financial markets. It was proved that if 100 traders start trading using a system with 60% winning odds, only 5 traders will be in profit at the end of the year. However, when forced to describe a methodology for the amount of capital to risk when trading, few traders have a concrete answer.

Making sure your forex trading funds are going to be giving you the maximum trading opportunities and value is something that every trader should be interested in. All forex trading money management strategies should incorporate stop loss orders. Limit your use of leverage

Money management is the other side. After the exchange rate has moved in a favorable In essence, you could be trading blind to the numbers which hugely determine your success or failure in trading.

It was proved that if 100 traders start trading using a system with 60%. If you have a forex trading strategy with a 70% win rate or above you should risk 10% of you capital on a trade. This explains why forex risk and money management practices remain an essential part of the business that needs to be incorporated into every.

Theforexsecret.com 2 introduction most traders do not forex trading is inherently practice proper money risky; There is real and management because present danger that you we have all heard the could lose money on any statistic that something. A forex trader unfamiliar with the strategies and techniques of money management forex will have an increased amount of losses.

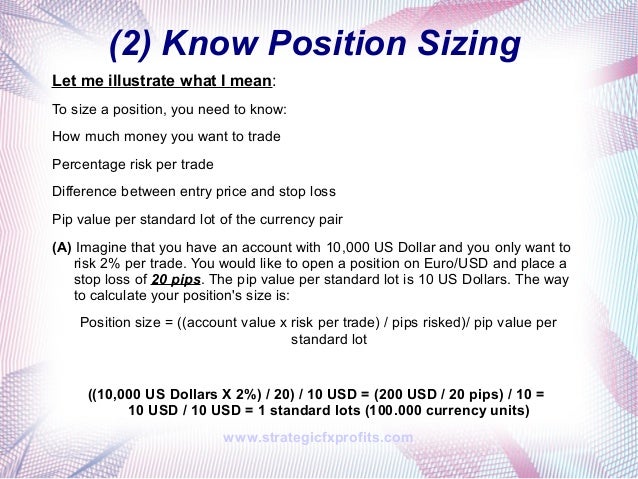

Whether you are trading in the stick or the forex market, you should know the strategies to effectively manage your money and grow your wealth. Know your risk per trade 2. The proper application of money management gives a forex trader an account growth edge, while trading forex without a logical money management strategy typically amounts to little more than gambling.

Ten tips for forex risk management. Strategies in forex powered by theforexsecret.com. Money management strategies post # 1;

Money management is important for all types of traders. Here are our top forex risk management tips, which will help you reduce your risk regardless of whether you are a new trader or a professional: Without money management, a forex trader cannot survive in the long run.

But unfortunately many traders ignore them due to a wide range of factors. Educate yourself about forex risk and trading; When people first come to trading and in particular forex the first thing they look to do is find the shiniest and fanciest trading system they can get their hands on.

Loss ratio, in other words, everything related to money.

Forex Money Management Strategy and Calculator

Forex Money Management Strategy and Calculator

Forex Money Management Formula Forex Scalping Strategy

Forex Money Management Formula Forex Scalping Strategy

Forex Strategy Money Management Ddfx Forex Trading

Forex Strategy Money Management Ddfx Forex Trading

Basic Money Management StrategiesRewardtoRisk Ratio In

Basic Money Management StrategiesRewardtoRisk Ratio In

Forex Money Management Strategies Rules and Tips Forex

Forex Money Management Strategies Rules and Tips Forex

Forex Money Management Lot Size Forex Fibonacci Scalper

Forex Money Management Lot Size Forex Fibonacci Scalper

ForexUseful Trend trading is not difficult once you

ForexUseful Trend trading is not difficult once you

Forex Money Management, Best Forex Money Management System

Forex Money Management, Best Forex Money Management System

Forex Risk Reward Ratio Quantina Forex News Trader Ea V4.51

Forex Risk Reward Ratio Quantina Forex News Trader Ea V4.51

Learn to Trade Forex Money strategy

Learn to Trade Forex Money strategy

Trading in Forex Money management techniques (averaging

Trading in Forex Money management techniques (averaging

Money Management in Forex More Than Just Trading

Money Management in Forex More Than Just Trading

Best Forex Signal Provider Money management, Forex, Risk

Best Forex Signal Provider Money management, Forex, Risk

Forex Money Management Simple Forex Trading Money

Forex Money Management Simple Forex Trading Money

Forex A Money Management Trick In Forex Trading

Forex A Money Management Trick In Forex Trading

No comments:

Post a Comment