1 lot will represent 100,000 units. Suppose an investor buys 0.1 lots, hence the contract size will be $11,869.9 (100,000 * 0.1 * 1.18699).

Forex Margin Level Percentage Calculator Are Forex

The standard size of one contract for most brokers is 100,000 units.

Contract size forex. Some online forex brokers even offer a smaller lot size than the micro lot in forex trades, which is known as a nano lot, and which is used for buying or selling multiples of 100 units of base currency. Sekarang, kami sangat yakin jika anda sedang kebingungan ketika hendak mempelajari tentang forex. Forex is commonly traded in specific amount called lots.

Belajar forex memang tidak semudah yang terbayangkan. The standard size for a lot is 100,000 units. Forex is traded in specific amounts called lots.

The price movements of different trading instruments vary with the tick size representing the minimum incremental. Contract specifications are a set of conditions that set the terms for how that product will trade. Information in contract specifications table is organized by trading account types.

It requires only few input values, but allows you to tune it finely to your specific needs. Namun ada juga broker yang menyediakan tipe akun selain akun standard seperti mini lot = $10000 dan micro lot = $1000. Hal tersebut sangat benar dan terbukti dengan banyaknya hal yang perlu dipelajari pada dunia forex itu sendiri.

I don't know about the calculator but i the contract size is different at different brokers. The contract size in forex is consistent for this kind of futures and also options contracts, as well as differs based on the financial instrument or commodity which. Variation in forex contract size.

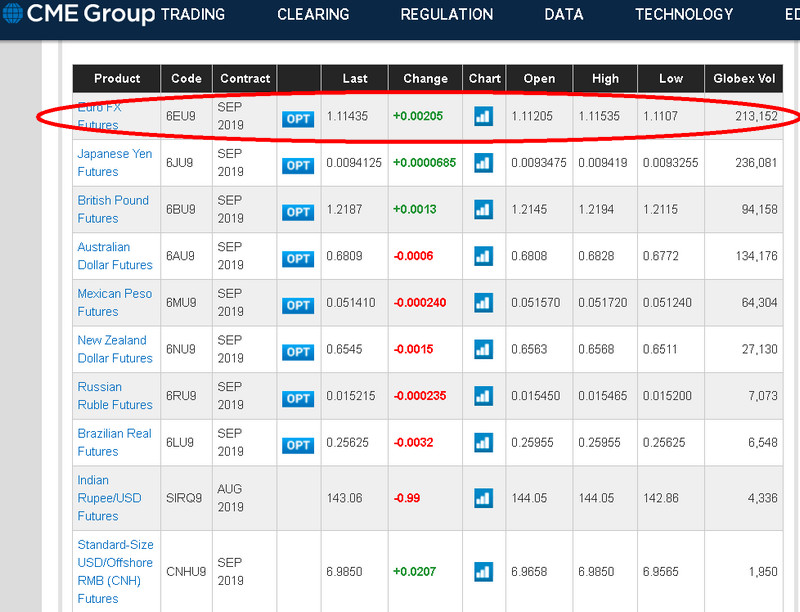

Contract specification on forex market by broker contract specification on forex market by broker. The contract forex futures contract size period is the period between the next tick after the start and the end. For an instance, the contract size of gold futures contract is 100 ounces (on comex), so move.

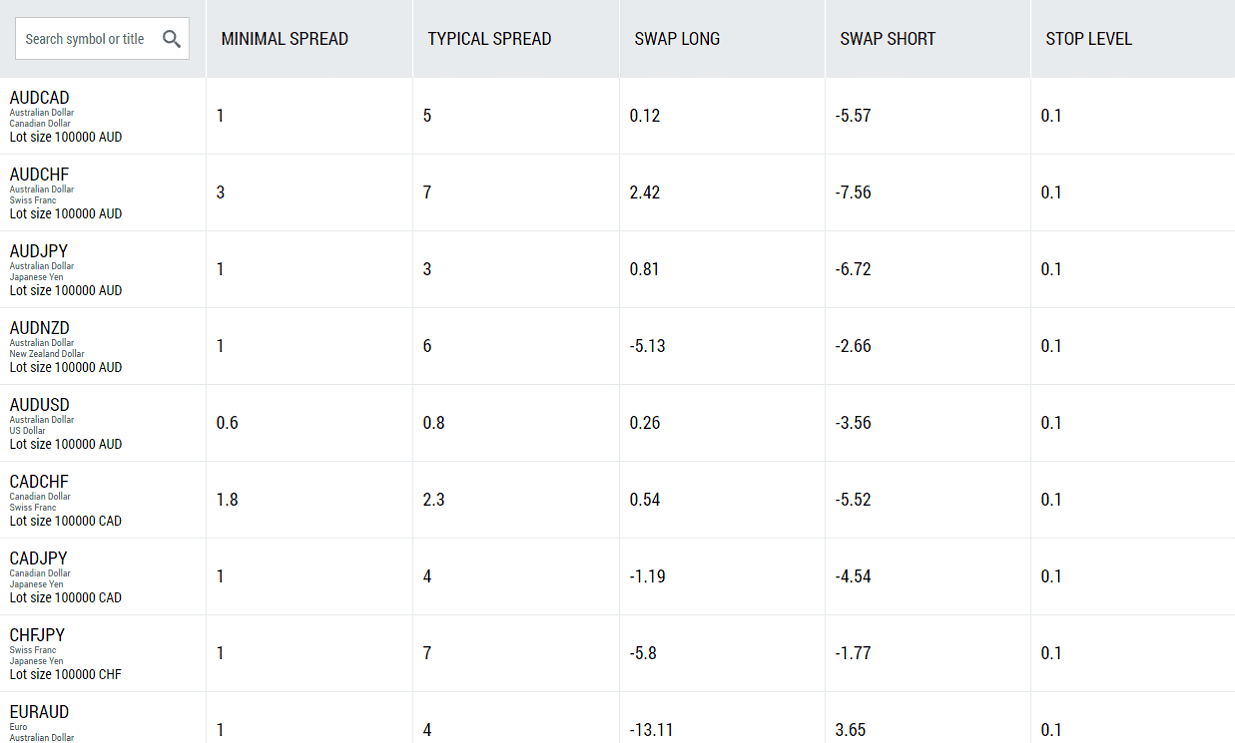

Pada umumnya, contract size yang sering dipakai adalah standard lot, mini lot dan micro lot. The position size calculator will calculate the required position size based on your currency pair, risk level (either in terms of percentage or money) and the stop loss in pips. This is the most important step for determining forex position size.

The start is when the contract is processed by our servers. A tick size is the minimum price movement of a trading instrument. It works with all major currency pairs and crosses.

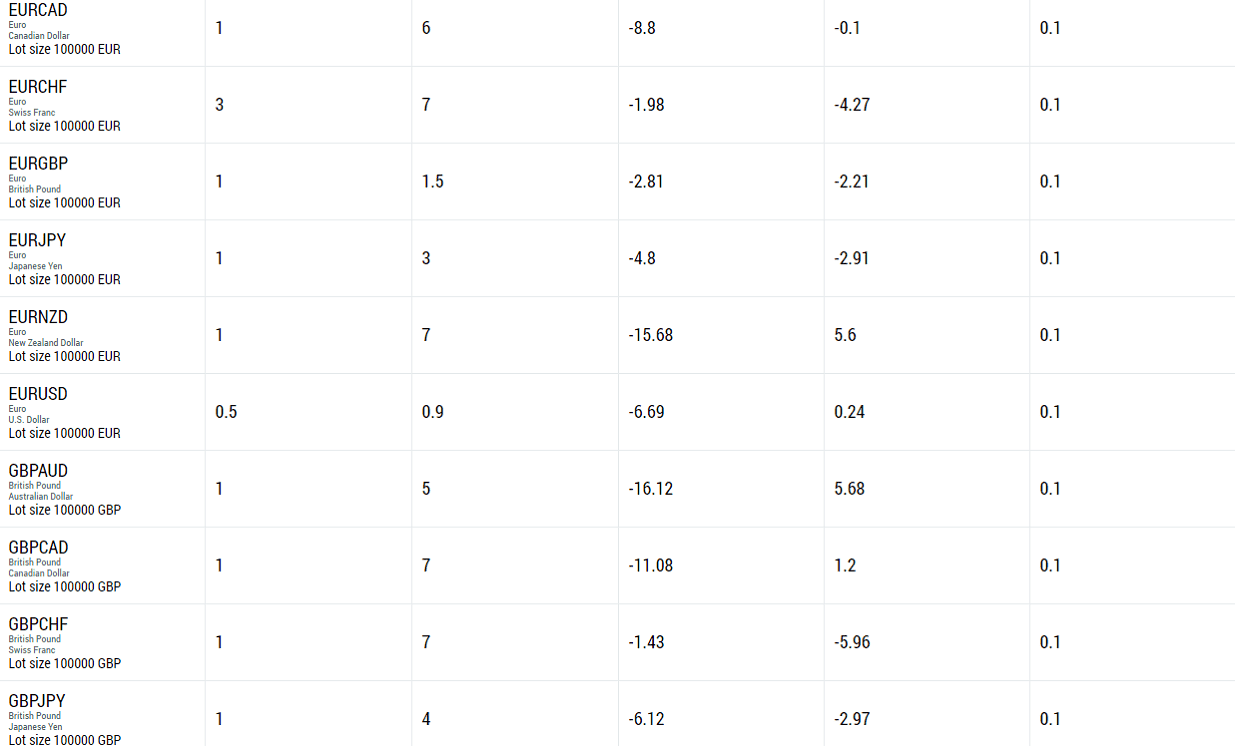

In this case, fxtm’s contract specifications refer to the minimum spreads, pip value and swap for each financial product that we offer. Set a percentage or dollar amount limit you'll risk on each trade. Position size position size calculator values.

Position size calculator — a free forex tool that lets you calculate the size of the position in units and lots to accurately manage your risks. There are also a mini, micro, and nano lot sizes. Using the tabs with the names of assets (currency pairs, indices, cryptocurrencies, or metals) available for the account type, you can easily find the instrument that you’re interested in and view all necessary data related to it, from spread to 1 pip size.

Suppose the exchange rate of this pair increases by one pip. Standard lot sama dengan $100.000, mini lot adalah $10.000 dan micro lot adalah $1000. It is true that contract size for most of the equity option contracts is 100 shares.

Both of these smaller lot sizes will tend to appeal to: Justforex is a retail forex broker that provides traders the access to the foreign exchange market and offers great trading conditions on accounts such as standard cent, standard, pro, raw spread, a wide choice of trading instruments, a leverage up to 1:3000, tight spreads, market news, and economic calendar. Please ensure that you understand the relevant contract specifications before trading.

The contract size for all currency pairs is 100,000 base currency units. Definition the term contract size identifies this approximate amount of a product or collateral called the underlying advantage in a futures or options contract. Generally when dealing with forex, the contract size is the same everywhere, ie 1 lot = 100 000 units.

If you need any clarification, please contact nadex and our trading support team can advise you further. 1 unit of eurusd will be equal to 1.18699 usd. Explanation the contract size is also an.

The deliverable quantity, and so the contract dimensions, for both futures and options contracts are standardized nevertheless vary in line with the underlying advantage. Pada umumnya broker forex menetapkan contract size 1 lot nya = $100000 pada akun standar. Dengan danya leverage ini, dana yang relatif kecil bisa melakukan transaksi dengan nilai kontrak yang jauh lebih besar.

Memahami lebih dalam tentang pip dan contract size dalam forex. For example, if you have a $10,000 trading account, you could risk $100 per trade if you use that 1% limit. With the advent of cfd's for commodities, indexes, crypto, and so on, they have had to get creative with what 1 lot is.

Find important information regarding contract specifications for forex, including expiration times, trading hours, underlying markets and more. Para broker forex menerapkan leverage dalam transaksi trading forex. For metatrader the smallest contract size is 0.01.

For example, the contract size for a canadian dollar futures contract is c$100,000, the size of a soybean contract traded on the chicago board of trade is 5,000 bushels, and the size of a gold. The terms forex, forex currency pairs, and spot currency or fx as mentioned on the company’s website, refer to cfds on spot foreign exchange. Contract size merupakan jumlah terkecil dalam trading forex.

In the above example, if i enter a long position 1 lot of gbp/usd, i would have entered a contract size of 1.25087*100,000 units*1 lot = 125,087 usd. Commissions per lot traded may or may not be applied depending on the account type. But the size of contract for financial instruments and commodities like interest rate futures and currencies generally varies widely.

The end is the selected number of minutes/hours after the start (if less than one forex futures contract size day in duration),. Total swap indicated in percentage is calculated as contract size of 1 lot * amount of lots * swap value in percentage / 360, received value must be converted from contract currency into account currency.

Forex Contract Value Forex Ea Writer

Forex Contract Value Forex Ea Writer

FBS Review Forex Brokers Reviews & Ratings

FBS Review Forex Brokers Reviews & Ratings

What Is A Lot In Forex Trading? AndyW

What Is A Lot In Forex Trading? AndyW

Forex Contract Size And Leverage Question Forex Fancy Bot

Forex Contract Size And Leverage Question Forex Fancy Bot

Forex Contract Size And Leverage Question Forex Retro

Forex Contract Size And Leverage Question Forex Retro

Forex Contract Size And Leverage Question Forex Fancy Bot

Forex Contract Size And Leverage Question Forex Fancy Bot

E Mini Nasdaq Contract Size Forex

Forex Contract Size And Leverage Question Forex Retro

Forex Contract Size And Leverage Question Forex Robot

Forex Contract Size And Leverage Question Forex Robot

What are the advantages of FOREX trading

What are the advantages of FOREX trading

Marginal zone Forex or How to predict the movement of

Marginal zone Forex or How to predict the movement of

Forex Trading Hours Calculator Jpy Forex Ea

Forex Trading Hours Calculator Jpy Forex Ea

4 essentials you must know to start trading forex

What are the best Forex Brokers in 2020?

What are the best Forex Brokers in 2020?

Forex Futures Contract Specifications Forex Ea Generator 6.2

Forex Futures Contract Specifications Forex Ea Generator 6.2

Apa Itu Point dan Contract Size dalam Dunia Trading Forex

Apa Itu Point dan Contract Size dalam Dunia Trading Forex

FBS Review Forex Brokers Reviews & Ratings

FBS Review Forex Brokers Reviews & Ratings

Forex Futures Contract Specifications Xfx Trading

No comments:

Post a Comment