Correlation can be even a more powerful forex tool for analysis in conjunction with other forex indicators. You can find many websites that calculate the forex pairs correlation table.

For instance, if one pair breaks out above or below a significant technical level of support or resistance, the closely positively correlated pair has a high probability of the following risk.

Forex pair correlation. Taking eur/jpy and aud/jpy as an example, we can see that the japanese yen is included in both pairs and is the source of correlation. This indicator is utilized for forex exchanging framework and binary exchanging framework. As mentioned previously, when trading more than one currency pair, a forex trader is either knowingly or unknowingly involved in forex correlation trading.

A strong positive correlation may turn out to be a negative correlation; The following tables represent the correlation between the various parities of the foreign exchange market. They show the history and the distribution of the correlation over a given period.

In the conventional sense, you would open two of the same positions if the correlation was positive, or two opposing positions if the correlation was negative. I've seen this correlation in 4 hour charts and see that when you overlay the graphs, the correlation itself signals going long one pair and short the other, but like any other system, there are a lot of false signals, as if the two are headed together, but suddenly reverse in opposite directions, per the strong corrolation characteristic. In forex markets, correlation is used to predict which currency pair rates are likely to move in tandem.

Note that forex correlation can be measured technically, and here, you will understand how much each currency pairs are related and to what degree they might be in tandem with each other. You can trade on forex pair correlations by identifying which currency pairs have a positive or negative correlation to each other. The forex pairs correlation table shows the examples of correlations among currencies that are highly traded in the world.

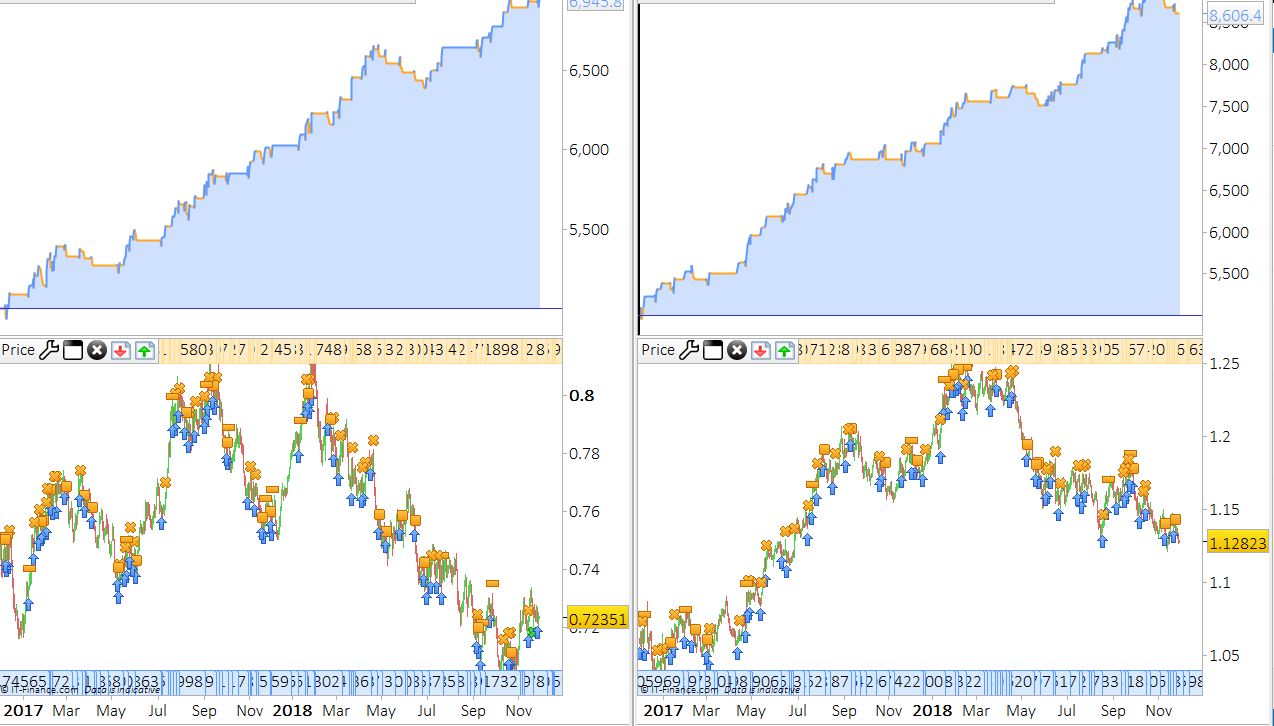

Calculate forex majors, minors, and cross currency pairs correlation here: The charts give precise details on the correlation between two parities. The forex currency pair correlation table shows the correlations that were calculated over a period of one month.

If so, you have to be aware of the currency pairs correlation, because of two main reasons:. In forex correlation pairs trading, the most used term is “currency pair correlation coefficient.” it actually measures the correlation between different currency pairs and financial assets in the forex market. Utilizing correlations in forex trading.

Simply put, fx pairs are interdependent and therefore correlated to one another. Forex correlation occurs due to a small number of currencies that can make up a currency pair. Correlation is an excellent tool for any forex trader as it allows them to reap more profits and reduce their risk exposure.

Equally, a correlation on the same pair could be different depending on the time frame of the trade you are looking at. Currency pairs correlation in forex market: The currency pair correlation calculator will show the value of positive and negative correlation.

In the financial world, correlation is the statistical measure of the relationship between two assets. If correlation should ever compute to 0, then both currency pairs possess no correlation to one another. The trader should first consider how to market correlation influences the value of currencies to comprehend the idea of forex correlation in currency pairs.

Find out what are currency pair correlations. How to trade on forex pair correlations. This forex correlation strategy is based on currency correlation.

For instance, if one pair breaks out. The correlation indicator is an indicator intended for meta trader 4 stage. If two currency pairs move in the same direction, one pair moves up, the other pair also move up.

Perfect positive correlation (a correlation coefficient of +1) implies that the two currency pairs will move in the same direction 100% of the time. Included with the latest release of ninjatrader 8, the fx correlation window is a powerful new tool used to detect and display correlation between multiple forex instruments at once. A correlation of +1 or 100 means two currency pairs will move in the same direction 100% of the time.

How to trade on forex pair correlations. A currency pair is said to be showing positive correlation when two or more currency pairs move. Correlation is a factual instrument that quantifies the correlation between two advantages.

However, there are practically no trading tactics based on. A positive and strong correlation of any currency pair may turn out to be a totally negative correlation. The changes in the correlation type of a particular forex currency are based on the time factor.

Negatively correlated currencies can also be utilized for hedging purposes. One way of applying a forex correlation strategy in your trading plan is by using correlations to diversify risk. It was done utilizing the pearson correlation coefficient.

Currency pair correlation strength visual cue. In the conventional sense, you would open two of the same positions if the correlation was positive, or two opposing positions if the correlation was negative. There is a simple and highly effective forex correlation calculator at investing.com.

Therefore, if yen begins to strengthen, these two pairs will move in the same direction. You can trade on forex pair correlations by identifying which currency pairs have a positive or negative correlation to each other. When there is a signal formed with a pair that has to be confirmed to form a trade setup, i refer to the correlated currency pairs or cross currency pairs and.

Meaning of currency pairs correlation in forex. Correlation can be even a more powerful forex tool for analysis in conjunction with other forex indicators. Since fx instruments are priced in pairs, no single forex pair behaves independently.

Correlation filter type in the correlation criteria to find the least and/or most correlated forex currencies in real time.

Correlation Forex pairs on same strategy, better

Correlation Forex pairs on same strategy, better

GhaniFx_Unique MTF Correlation MT4 Indicator. What is

GhaniFx_Unique MTF Correlation MT4 Indicator. What is

Forex Pairs With Negative Correlation Forex Holy Grail

Forex Pairs With Negative Correlation Forex Holy Grail

What Forex Pairs Are Correlated Forex Ea Crack

What Forex Pairs Are Correlated Forex Ea Crack

Trend forex pairs correlation and regression examples

GhaniFx_Unique MTF Correlation MT4 Indicator. FxGhani

GhaniFx_Unique MTF Correlation MT4 Indicator. FxGhani

Forex Pairs Correlation Chart Forex Robot Source Code

Forex Pairs Correlation Chart Forex Robot Source Code

Trend forex pairs correlation formula investment

Forex Correlation Table Are You Doubling Your Risk?

Forex Correlation Strategy (TRADE FOREX CORRELATION)

Forex Correlation Strategy (TRADE FOREX CORRELATION)

Forex Pairs That Correlate Find Out The Best Ones In 2020

Forex Pairs That Correlate Find Out The Best Ones In 2020

Strategi Trading Forex Poster Korelasi Kekuatan Suatu

Strategi Trading Forex Poster Korelasi Kekuatan Suatu

Korelasi Pasangan Mata uang Trading Forex OctaFX

Korelasi Pasangan Mata uang Trading Forex OctaFX

Currency Pair Correlations Forex Trading OctaFX

Currency Pair Correlations Forex Trading OctaFX

.png) Live Forex Correlation Table Forex Copy Trade System

Live Forex Correlation Table Forex Copy Trade System

CROSS CURRENCY PAIRS CORRELATION ADVANCED ANALYSIS for

CROSS CURRENCY PAIRS CORRELATION ADVANCED ANALYSIS for

Forex Pairs That Correlate Find Out The Best Ones In 2020

Forex Pairs That Correlate Find Out The Best Ones In 2020

No comments:

Post a Comment